|

|

| (未显示同一用户的2个中间版本) |

| 第1行: |

第1行: |

| 加密货币的法律地位因司法管辖区的不同而有很大差异,并且在许多地方仍未定义或正在变化中。在大多数国家中,使用加密货币本身并不违法,但其作为支付手段(或商品)的地位和可用性各不相同,具有不同的监管影响。

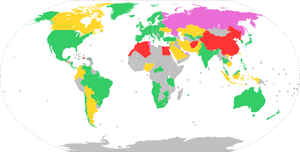

| | [[文件:Legal status of bitcoin.png|缩略图| |

| | {| class="wikitable" |

| | |+ |

| | !<big>比特币的法律地位</big> |

| | |- |

| | |<big>'''法定货币'''<sup>橙色</sup></big> |

| | |- |

| | |<big>'''允许'''(合法使用比特币)<sup>绿色</sup></big> |

| | |- |

| | |<big>'''有争议'''(对比特币的合法使用有一些限制)<sup>黄色</sup></big> |

| | |- |

| | |<big>'''有争议'''(基于现有法律的解释,但不直接禁止比特币)<sup>粉色</sup></big> |

| | |- |

| | |<big>'''禁止'''(全部或部分禁止)<sup>红色</sup></big> |

| | |- |

| | |<big>没有数据<sup>灰色</sup></big> |

| | |} |

| | ]]加密货币的法律地位因司法管辖区的不同而有很大差异,并且在许多地方仍未定义或正在变化中<ref>https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3042248</ref>。在大多数国家中,使用加密货币本身并不违法,但其作为支付手段(或商品)的地位和可用性各不相同,具有不同的监管影响<ref>https://medium.com/coinmonks/cryptos-big-legal-problems-63b760385fea</ref>。 |

|

| |

|

| 一些国家明确允许其使用和交易,而另一些国家则禁止或限制其使用。同样,各种政府机构、部门和法院对加密货币的分类也有所不同。 | | 一些国家明确允许其使用和交易,而另一些国家则禁止或限制其使用。同样,各种政府机构、部门和法院对加密货币的分类也有所不同。 |

| [[文件:Legal status of bitcoin.png|缩略图|<big>比特币的法律地位</big>

| | == 在各国家或地区的细节 == |

| * <big>'''法定货币'''<sup>橙色</sup></big>

| |

| * <big>'''允许'''(合法使用比特币)<sup>绿色</sup></big>

| |

| * <big>'''有争议'''(对比特币的合法使用有一些限制)<sup>黄色</sup></big>

| |

| * <big>'''有争议'''(基于现有法律的解释,但不直接禁止比特币)<sup>粉色</sup></big>

| |

| * <big>'''禁止'''(全部或部分禁止)<sup>红色</sup></big>

| |

| * <big>没有数据<sup>灰色</sup></big>]]

| |

|

| |

|

| == 在各国家或地区的细节 == | | === 联盟国家 === |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |国家或地区 | | ! style="width:120px;" |国家或地区 |

| 第206行: |

第217行: |

| ----根据阿根廷民法典,比特币可能被视为货币,但不是法定货币。比特币可能被视为民法典下的一种物品或者商品,因此与比特币相关的交易可能受民法典下的商品买卖规则约束。2022年5月5日,阿根廷央行禁止金融机构 facilitat 任何与加密货币相关的交易。 | | ----根据阿根廷民法典,比特币可能被视为货币,但不是法定货币。比特币可能被视为民法典下的一种物品或者商品,因此与比特币相关的交易可能受民法典下的商品买卖规则约束。2022年5月5日,阿根廷央行禁止金融机构 facilitat 任何与加密货币相关的交易。 |

| |- | | |- |

| |{{flag|Bolivia}}{{anchor|Bolivia}} | | |玻利维亚 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----The [[Central Bank of Bolivia]] issued a resolution banning bitcoin and any other currency not regulated by a country or economic zone in 2014.<ref name="bol">{{cite web|url=http://www.ibtimes.co.uk/cryptocurrency-round-bolivian-bitcoin-ban-ios-apps-dogecoin-mcdonalds-1453453|title=Cryptocurrency Round-Up: Bolivian Bitcoin Ban, iOS Apps & Dogecoin at McDonald's|publisher=International Business Times|work=ibtimes.co.uk|date=20 June 2014|access-date=23 February 2015|author=Cuthbertson, Anthony|archive-date=24 September 2015|archive-url=https://web.archive.org/web/20150924050741/http://www.ibtimes.co.uk/cryptocurrency-round-bolivian-bitcoin-ban-ios-apps-dogecoin-mcdonalds-1453453|url-status=live}}</ref> Resolution of the Central Bank of Bolivia No. 144 of Dec. 15, 2020 repealed Resolution No. 044 of May 6, 2014.{{cn|date=April 2024}} | | ----玻利维亚中央银行于2014年发布了一项决议,禁止比特币以及任何其他未受任何国家或经济区域监管的货币。截至2020年12月15日,玻利维亚中央银行第144号决议废除了2014年5月6日的第044号决议。 |

| |- | | |- |

| |{{flag|Brazil}}{{anchor|Brazil}} | | |巴西 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----In December 2022, Brazil established a licensing regime for virtual asset service providers with the aim of legalizing crypto as a payment method. Previously regulated, according to a 2014 statement by the [[Central Bank of Brazil]] concerning cryptocurrencies, but is discouraged because of operational risks.<ref>{{Cite web|url=https://www3.bcb.gov.br/normativo/detalharNormativo.do?method=detalharNormativo&N=114009277|title=COMUNICADO Nº 25.306, DE 19 DE FEVEREIRO DE 2014|date=19 February 2014|publisher=[[Banco Central do Brasil]]|access-date=11 September 2016|archive-date=27 April 2019|archive-url=https://web.archive.org/web/20190427001220/https://www3.bcb.gov.br/normativo/detalharNormativo.do?method=detalharNormativo&N=114009277|url-status=live}}</ref> In November 2017 this unregulated and discouraged status was reiterated by the Central Bank of Brazil.<ref>{{Cite web|url=http://www.bcb.gov.br/pre/normativos/busca/normativo.asp?numero=31379&tipo=Comunicado&data=16/11/2017|title=Comunicado nº 31.379, de 16/11/2017|website=Bcb.gov.br|language=pt-br|access-date=17 November 2017|archive-date=26 July 2018|archive-url=https://web.archive.org/web/20180726231905/http://www.bcb.gov.br/pre/normativos/busca/normativo.asp?numero=31379&tipo=Comunicado&data=16/11/2017|url-status=live}}</ref> On 7 May 2019, the [[Receita Federal do Brasil|Special Department of Federal Revenue of Brazil]] published a document on cryptocurrency taxes in the country.<ref>{{Cite web|url=http://normas.receita.fazenda.gov.br/sijut2consulta/link.action?visao=anotado&idAto=100592|title=INSTRUÇÃO NORMATIVA RFB Nº 1888, DE 03 DE MAIO DE 2019|date=3 May 2019|access-date=4 March 2021|publisher=[[Receita Federal de Brasil]]|archive-date=30 November 2020|archive-url=https://web.archive.org/web/20201130170504/http://normas.receita.fazenda.gov.br/sijut2consulta/link.action?visao=anotado&idAto=100592|url-status=live}}</ref> | | ----巴西在2022年12月建立了虚拟资产服务提供者的许可制度,旨在将加密货币合法化为一种支付方式。根据巴西中央银行2014年的声明,加密货币虽然受到监管,但由于运营风险而不被鼓励。2017年11月,巴西中央银行重申了这种未受监管和不鼓励的立场。2019年5月7日,巴西联邦税务特别部门发布了有关该国加密货币税收的文件。 |

| |- | | |- |

| |{{flag|Chile}}{{anchor|Chile}} | | |智利 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----There is no regulation on the use of bitcoins.{{r|"regulation"|page=Chile}} | | ----在智利,比特币的使用没有受到任何法规限制。 |

| |- | | |- |

| |{{flag|Colombia}}{{anchor|Colombia}} | | |哥伦比亚 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----Financial institutions are not allowed to facilitate bitcoin transactions. The Superintendencia Financiera warned financial institutions in 2014 that they may not "protect, invest, broker, or manage virtual money operations".<ref name="RCAWJune2018LOC">{{cite web|title=Regulation of Cryptocurrency Around the World|url=https://www.loc.gov/item/2021687419/|website=Library of Congress|publisher=The Law Library of Congress, Global Legal Research Center|access-date=14 August 2018|date=June 2018|archive-date=16 December 2021|archive-url=https://web.archive.org/web/20211216083958/https://www.loc.gov/item/2021687419/|url-status=live}}</ref> | | ----金融机构不允许进行比特币交易。2014年,哥伦比亚金融监管机构警告金融机构不得“保护、投资、代理或管理虚拟货币交易”。 |

| |- | | |- |

| |{{flag|Ecuador}}{{anchor|Ecuador}} | | |厄瓜多尔 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to trade and hold / [[文件:X_mark.svg|17x17像素]] 不合法 as a payment tool, banking ban | | |[[文件:Yes_check.svg|15x15像素]] 持有及交易合法 / [[文件:X_mark.svg|17x17像素]] 央行禁止作为支付工具 |

| ----Usage of any cryptocurrency as a payment tool is banned, according to Article 98 of the Organic Code on Monetary and Financial Matters, with sanctions that includes the seizure of cryptocurrencies and any product acquired with them.<ref>{{Cite web|title=Regulation of Cryptocurrency Around the World: November 2021 Update|url=https://tile.loc.gov/storage-services/service/ll/llglrd/2021687419/2021687419.pdf|website=Law Library of Congress|access-date=26 December 2021|archive-date=24 December 2021|archive-url=https://web.archive.org/web/20211224043203/https://tile.loc.gov/storage-services/service/ll/llglrd/2021687419/2021687419.pdf|url-status=live}}</ref> As of December 25, 2021, no person has been criminally prosecuted for this reason. The Ecuadorian financial system strictly blocks any cryptocurrency-related transaction. Despite this, on January 8, 2018, according to a statement issued by the [[Central Bank of Ecuador]], the purchase and sale of bitcoins is legal.<ref>{{Cite web|title=COMUNICADO OFICIAL SOBRE EL USO DEL BITCOIN|url=https://www.bce.fin.ec/index.php/boletines-de-prensa-archivo/item/1028-comunicado-oficial-sobre-el-uso-del-bitcoin|access-date=7 February 2021|website=www.bce.fin.ec|archive-date=3 February 2021|archive-url=https://web.archive.org/web/20210203221632/https://www.bce.fin.ec/index.php/boletines-de-prensa-archivo/item/1028-comunicado-oficial-sobre-el-uso-del-bitcoin|url-status=live}}</ref> | | ----根据《货币和金融事务有机法典》第98条款,禁止使用任何加密货币作为支付工具,违者将面临没收加密货币及用其购买的任何产品的处罚。截至2021年12月25日,尚无人因此原因受到刑事起诉。厄瓜多尔金融系统严格阻止任何与加密货币相关的交易。尽管如此,在2018年1月8日,根据厄瓜多尔央行发布的声明,比特币的买卖是合法的。 |

| |- | | |- |

| |{{flag|Venezuela}} | | |委内瑞拉 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to hold / [[文件:X_mark.svg|17x17像素]] 不合法 to mine | | |[[文件:Yes_check.svg|15x15像素]] 持有合法 / [[文件:X_mark.svg|17x17像素]] 挖矿不合法 |

| ----In January 2018 Carlos Vargas, the government's cryptocurrency superintendent said "It is an activity that is now perfectly legal. We have had meetings with the Supreme Court so that people who have been victims of seizures and arrests in previous years will have charges dismissed."<ref>{{Cite news|url=https://www.crypto-economy.net/en/venezuelan-government-announces-new-monetary-cone-pegged-to-petro/|title=Venezuelan government announces new monetary cone pegged to Petro|last=Teodoro|first=Carlos|date=27 July 2018|work=Crypto Economy|access-date=27 July 2018|archive-date=8 October 2018|archive-url=https://web.archive.org/web/20181008142018/https://www.crypto-economy.net/en/venezuelan-government-announces-new-monetary-cone-pegged-to-petro/|url-status=live}}</ref>{{unreliable source|date=October 2023}} In March 2023, regulators issued a temporary ban on all cryptocurrency mining, due to concerns over corruption and embezzlement. As of June the ban remained in place.<ref>{{cite news|last1=Yapur|first1=Nicolle|last2=Itriago Acosta|first2=Andreina|title=Venezuela's Ban on Crypto Mining Is Ruining the Industry It Once Embraced|url=https://www.bloomberg.com/news/articles/2023-06-21/venezuela-once-embraced-crypto-now-it-s-banned-crypto-mining-trading-petro|access-date=15 October 2023|work=Bloomberg.com|date=21 June 2023|archive-url=https://archive.today/20230622015054/https://www.bloomberg.com/news/articles/2023-06-21/venezuela-once-embraced-crypto-now-it-s-banned-crypto-mining-trading-petro|archive-date=22 June 2023|language=en}}</ref> | | ----在2018年1月,政府的加密货币监督官卡洛斯·瓦尔加斯表示:“这是一项现在完全合法的活动。我们与最高法院举行了会议,以便对那些在之前几年被扣押和逮捕的人解除指控。”然而,在2023年3月,监管机构因为对腐败和侵占的担忧,发布了一项临时禁令,禁止所有加密货币的挖矿活动。截至6月,这项禁令仍然有效。 |

| |} | | |} |

|

| |

|

| === Asia === | | === 亚洲 === |

|

| |

|

| ==== Central Asia ==== | | ==== 中亚 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|Afghanistan}}{{anchor|Afghanistan}} | | |阿富汗 |

| |[[文件:X_mark.svg|17x17像素]] 不合法 | | |[[文件:X_mark.svg|17x17像素]] 不合法 |

| ----In August 2022 Taliban banned trading in cryptocurrencies.<ref>[https://www.bloomberg.com/news/articles/2022-08-26/taliban-ban-crypto-in-afghanistan-arrest-digital-coin-dealers Taliban Ban Crypto in Afghanistan, Arrest Dealers of Tokens] {{Webarchive|url=https://web.archive.org/web/20230701120648/https://www.bloomberg.com/news/articles/2022-08-26/taliban-ban-crypto-in-afghanistan-arrest-digital-coin-dealers|date=1 July 2023}}, 26 August 2022</ref> | | ----2022年8月,塔利班禁止了加密货币交易。 |

| |- | | |- |

| |{{flag|Kyrgyzstan}}{{anchor|Kyrgyzstan}} | | |吉尔吉斯斯坦 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Bitcoin is considered a commodity,<ref>{{cite web|url=http://en.kyrgyzbusiness.com/blockchain-en/|title=Kyrgyzstan and Crypto Business|publisher=International Finance Centre Development Agency|work=en.kyrgyzbusiness.com|date=2018|access-date=4 April 2018|archive-date=4 April 2018|archive-url=https://web.archive.org/web/20180404135339/http://en.kyrgyzbusiness.com/blockchain-en/|url-status=live}}</ref> not a security or currency under the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange.<ref name="kyr">{{cite web|url=https://akipress.com/news:604488/|title=New report on Legal Status of Blockchain Commerce in the Kyrgyz Republic released|publisher=AKIpress News Agency|work=akipress.com|date=2018|access-date=4 April 2018|archive-date=4 April 2018|archive-url=https://web.archive.org/web/20180404201039/https://akipress.com/news:604488/|url-status=live}}</ref> The use of bitcoin as a currency in domestic settlements is restricted.<ref>{{cite web|url=http://www.nbkr.kg/searchout.jsp?item=31&material=50718&lang=ENG|title=Warning of the National Bank of the Kyrgyz Republic on the spread and use of the "virtual currency", in particular, bitcoins (bitcoin)|publisher=National Bank of the Kyrgyz Republic|work=nbkr.kg|date=18 July 2014|access-date=23 February 2015|archive-date=22 February 2015|archive-url=https://web.archive.org/web/20150222230016/http://www.nbkr.kg/searchout.jsp?item=31&material=50718&lang=ENG|url-status=live}}</ref> | | ----在吉尔吉斯斯坦共和国的法律下,比特币被视为一种商品,而不是证券或货币,可以在本地商品交易所合法进行挖掘、购买、销售和交易。然而,比特币在国内结算中使用作为货币的行为受到限制。 |

| |- | | |- |

| |{{flag|Uzbekistan}}{{anchor|Kyrgyzstan}} | | |乌兹别克斯坦 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----On 2 September 2018, a decree legalizing crypto trading — also making it tax-free — and mining in the country came into force, making Uzbekistan a crypto-friendly state.<ref>{{Cite web|url=https://static.norma.uz/official_texts/%D0%9E%20%D0%BC%D0%B5%D1%80%D0%B0%D1%85%20%D0%BF%D0%BE%20%D0%BE%D1%80%D0%B3%D0%B0%D0%BD%D0%B8%D0%B7%D0%B0%D1%86%D0%B8%D0%B8%20%D0%B4%D0%B5%D1%8F%D1%82%D0%B5%D0%BB%D1%8C%D0%BD%D0%BE%D1%81%D1%82%D0%B8%20%D0%BA%D1%80%D0%B8%D0%BF%D1%82%D0%BE-%D0%B1%D0%B8%D1%80%D0%B6%20%D0%B2%20%D0%A0%D0%B5%D1%81%D0%BF%D1%83%D0%B1%D0%BB%D0%B8%D0%BA%D0%B5%20%D0%A3%D0%B7%D0%B1%D0%B5%D0%BA%D0%B8%D1%81%D1%82%D0%B0%D0%BD.pdf|title=decree "On measures to organize the activities of crypto-exchanges in Uzbekistan", № ПП-3926 from September 2nd 2018|website=Static.nora.uz|access-date=15 September 2018|archive-date=15 September 2018|archive-url=https://web.archive.org/web/20180915225931/https://static.norma.uz/official_texts/%D0%9E%20%D0%BC%D0%B5%D1%80%D0%B0%D1%85%20%D0%BF%D0%BE%20%D0%BE%D1%80%D0%B3%D0%B0%D0%BD%D0%B8%D0%B7%D0%B0%D1%86%D0%B8%D0%B8%20%D0%B4%D0%B5%D1%8F%D1%82%D0%B5%D0%BB%D1%8C%D0%BD%D0%BE%D1%81%D1%82%D0%B8%20%D0%BA%D1%80%D0%B8%D0%BF%D1%82%D0%BE-%D0%B1%D0%B8%D1%80%D0%B6%20%D0%B2%20%D0%A0%D0%B5%D1%81%D0%BF%D1%83%D0%B1%D0%BB%D0%B8%D0%BA%D0%B5%20%D0%A3%D0%B7%D0%B1%D0%B5%D0%BA%D0%B8%D1%81%D1%82%D0%B0%D0%BD.pdf|url-status=live}}</ref> | | ----在2018年9月2日,乌兹别克斯坦颁布了一项法令,正式将加密货币交易和挖矿合法化,并且免税。这使得乌兹别克斯坦成为一个支持加密货币的国家。 |

| |} | | |} |

|

| |

|

| ==== West Asia ==== | | ==== 西亚 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|United Arab Emirates}}{{anchor|United Arab Emirates}} | | |阿联酋 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----According to the Library of Congress "The Central Bank does not recognize cryptocurrencies as a form of payment yet. However, it is working on a new regulation for retail payment services that introduces the concept of tokens that could be used for payment purposes."<ref name="RCAWNovember2021LOC">{{cite web|title=Regulation of Cryptocurrency Around the World|url=https://tile.loc.gov/storage-services/service/ll/llglrd/2021687419/2021687419.pdf|website=Library of Congress|publisher=The Law Library of Congress, Global Legal Research Center|access-date=9 February 2022|date=November 2021|archive-date=30 January 2022|archive-url=https://web.archive.org/web/20220130224349/https://tile.loc.gov/storage-services/service/ll/llglrd/2021687419/2021687419.pdf|url-status=live}}</ref> | | ----根据美国国会图书馆的资料,“中央银行尚未将加密货币视为一种支付形式。然而,该机构正在制定新的零售支付服务法规,引入了可用于支付目的的代币概念。” |

|

| |

|

| On 13 February 2018 Dubai gold trader Regal RA DMCC became the first company in the Middle East to get a license to trade cryptocurrencies, the Dubai Multi Commodities Centre said.<ref>{{cite news|last1=Carpenter|first1=Claudia|title=Journalist|url=https://www.bloomberg.com/news/articles/2018-02-12/dubai-trader-gets-first-middle-east-license-in-cryptocurrencies|website=Bloomberg.com|date=12 February 2018|access-date=13 February 2018|archive-date=13 February 2018|archive-url=https://web.archive.org/web/20180213004333/https://www.bloomberg.com/news/articles/2018-02-12/dubai-trader-gets-first-middle-east-license-in-cryptocurrencies|url-status=live}}</ref> DMCC's website emphasizes the "cold storage" of cryptocurrencies and states "DMCC's Crypto-commodities license is for Proprietary Trading in Crypto-commodities only. No initial coin offerings are permitted and no establishment of an exchange is permitted under this license."<ref>{{cite web|title=World's First Deep Cold Storage for Crypto-Commodities Launched by Regal Assets in Dubai|url=https://www.dmcc.ae/news/worlds-first-deep-cold-storage-crypto-commodities-launched-regal-assets-dubai|website=Dmcc.ae|access-date=14 August 2018|date=13 February 2018|archive-date=14 August 2018|archive-url=https://web.archive.org/web/20180814071623/https://www.dmcc.ae/news/worlds-first-deep-cold-storage-crypto-commodities-launched-regal-assets-dubai|url-status=live}}</ref>

| | 在2018年2月13日,迪拜多商品中心宣布,迪拜金商Regal RA DMCC成为中东首家获得加密货币交易许可的公司。DMCC的网站强调了加密货币的冷存储,并指出“DMCC的加密商品交易许可仅限于专有交易。不允许进行首次代币发行(ICO),也不允许在此许可下设立交易所。” |

|

| |

|

| In November 2020, the [[Securities and Commodities Authority]] published "The Chairman of the Authority's Board of Directors' Decision No. (23/Chairman) of 2020 Concerning Crypto Assets Activities Regulation." It establishes a regulatory framework for the offering, issuance, listing, and trading of crypto assets. Crypto assets providers must be incorporated onshore within the UAE.<ref>{{Cite web|url=https://www.keystonelaw.com/me/keynotes/uae-announces-new-regulations-for-licensing-crypto-assets/|title=UAE announces new regulations for licensing crypto assets|website=Keystone Law Dubai|access-date=16 April 2021|archive-date=16 April 2021|archive-url=https://web.archive.org/web/20210416082856/https://www.keystonelaw.com/me/keynotes/uae-announces-new-regulations-for-licensing-crypto-assets/|url-status=live}}</ref><ref>{{Cite web|url=https://www.sca.gov.ae/Content/Userfiles/Assets/Documents/f79fbf6.pdf|title=Regulation in Arabic|access-date=16 April 2021|archive-date=21 January 2021|archive-url=https://web.archive.org/web/20210121071215/https://www.sca.gov.ae/Content/Userfiles/Assets/Documents/f79fbf6.pdf|url-status=live}}</ref><ref>{{Cite web|url=https://www.sca.gov.ae/Content/Userfiles/Assets/Documents/8004151b.pdf|title=Regulation in English|access-date=16 April 2021|archive-date=28 November 2020|archive-url=https://web.archive.org/web/20201128171301/https://www.sca.gov.ae/Content/Userfiles/Assets/Documents/8004151b.pdf|url-status=live}}</ref><ref>{{Cite web|url=https://www.sca.gov.ae/en/media-center/news/29/3/2021/mou-between-dmcc-and-sca.aspx|title=MoU signed between SCA and DMCC | News | Media Center | Securities and Commodities Authority|access-date=16 April 2021|archive-date=25 July 2021|archive-url=https://web.archive.org/web/20210725003358/https://www.sca.gov.ae/en/media-center/news/29/3/2021/mou-between-dmcc-and-sca.aspx|url-status=live}}</ref>

| | 2020年11月,阿联酋证券与商品权威发布了《2020年主席理事会决定第23/主席号:关于加密资产活动监管的决定》,建立了加密资产的提供、发行、上市和交易的监管框架。加密资产提供者必须在阿联酋国内设立公司。 |

| |- | | |- |

| |{{flag|Israel}}{{anchor|Israel}} | | |以色列 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----As of 2017, the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency, and neither of that of a financial security, but of a taxable asset.<ref>{{Cite web|url=http://www.lawfirmwolf.com/bitcoin-israel-law|title=Bitcoin Israel - Q & A {{!}} Dave Wolf & Co. Law Offices|website=Lawfirmwolf.com|access-date=6 July 2017|archive-date=25 August 2018|archive-url=https://web.archive.org/web/20180825143159/http://www.lawfirmwolf.com/bitcoin-israel-law|url-status=live}}</ref> Each time a bitcoin is sold, the seller would have to pay a capital gains tax of 25%. Miners, traders of bitcoins would be treated as businesses and would have to pay corporate income tax as well as charge a 17% VAT.<ref>{{Cite web|url=https://taxes.gov.il/incometax/documents/hozrim/hoz_x_2017_tyota.pdf|title=Taxation of Cryptocurrency|last=Israeli Tax Authorities|date=2017|website=Taxes.gov.il|access-date=21 August 2017|archive-date=24 June 2019|archive-url=https://web.archive.org/web/20190624133358/https://taxes.gov.il/incometax/documents/hozrim/hoz_x_2017_tyota.pdf|url-status=live}}</ref> | | ----根据以色列税务当局2017年的声明,比特币和其他加密货币不被视为法定货币或金融证券,而是被视为应税资产。每次出售比特币时,卖方需缴纳25%的资本利得税。此外,比特币的挖矿者和交易者被视为企业,需缴纳企业所得税,并对其交易征收17%的增值税。 |

| |- | | |- |

| |{{flag|Saudi Arabia}}{{anchor|Saudi Arabia}} | | |沙特阿拉伯 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----Financial institutions are warned from using bitcoin.<ref name="RCAWJune2018LOC" /> The [[Saudi Central Bank]] (SAMA) has warned from using bitcoin as it is high risk and its dealers will not be guaranteed any protection or rights.<ref>{{Cite web|date=2017-07-04|title=تعرف على خطر عملة "بيتكوين" ولماذا منعتها السعودية|url=https://www.alarabiya.net/aswaq/economy/2017/07/04/%D8%A7%D9%84%D8%B3%D8%B9%D9%88%D8%AF%D9%8A%D8%A9-%D8%AA%D8%AD%D8%B0%D8%B1-%D9%85%D9%86-%D8%AA%D8%AF%D8%A7%D9%88%D9%84-%D8%A7%D9%84%D8%B9%D9%85%D9%84%D8%A9-%D8%A7%D9%84%D8%A5%D9%84%D9%83%D8%AA%D8%B1%D9%88%D9%86%D9%8A%D8%A9-%D8%A8%D9%8A%D8%AA%D9%83%D9%88%D9%8A%D9%86-|access-date=2023-06-21|website=العربية|language=ar|archive-date=22 June 2023|archive-url=https://web.archive.org/web/20230622001841/https://www.alarabiya.net/aswaq/economy/2017/07/04/%D8%A7%D9%84%D8%B3%D8%B9%D9%88%D8%AF%D9%8A%D8%A9-%D8%AA%D8%AD%D8%B0%D8%B1-%D9%85%D9%86-%D8%AA%D8%AF%D8%A7%D9%88%D9%84-%D8%A7%D9%84%D8%B9%D9%85%D9%84%D8%A9-%D8%A7%D9%84%D8%A5%D9%84%D9%83%D8%AA%D8%B1%D9%88%D9%86%D9%8A%D8%A9-%D8%A8%D9%8A%D8%AA%D9%83%D9%88%D9%8A%D9%86-|url-status=live}}</ref> | | ----沙特阿拉伯货币管理局(SAMA)已警告金融机构不要使用比特币,因为它具有高风险,其交易者将无法获得任何保护或权利。 |

| |- | | |- |

| |{{flag|Jordan}}{{anchor|Jordan}} | | |约旦 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems.<ref name="disco">{{cite web|url=http://www.dailystar.com.lb/Business/Lebanon/2014/Feb-24/248247-despite-warnings-bitcoin-gains-toehold-in-region.ashx|title=Despite warnings, Bitcoin gains toehold in region|publisher=The Daily Star|work=dailystar.com.lb|date=24 February 2014|access-date=17 June 2015|author=Knutsen, Elise|quote=[In February of 2014] the Central Bank of Jordan issued a warning against the currency, becoming the second government in the region to do so after Lebanon.|archive-date=2 September 2018|archive-url=https://web.archive.org/web/20180902000151/http://www.dailystar.com.lb/Business/Lebanon/2014/Feb-24/248247-despite-warnings-bitcoin-gains-toehold-in-region.ashx|url-status=live}}</ref> | | ----约旦央行禁止银行、货币兑换机构、金融公司和支付服务公司参与比特币或其他数字货币的交易。尽管警告公众比特币存在风险,并非法定货币,但小企业和商家仍然接受比特币支付。 |

| | |

| The Central Bank of Jordan prohibits banks, currency exchanges, financial companies, and [[payment service companies]] from dealing in bitcoins or other digital currencies.<ref name="jordantimes">{{cite news|url=http://jordantimes.com/central-bank-warns-against-using-bitcoin|work=The Jordan Times|title=Central bank warns against using bitcoin|first=Omar|last=Obeidat|date=22 February 2014|access-date=11 March 2014|archive-date=28 April 2015|archive-url=https://web.archive.org/web/20150428002618/http://jordantimes.com/central-bank-warns-against-using-bitcoin|url-status=live}}</ref> While it warned the public of risks of bitcoins, and that they are not legal tender, bitcoins are still accepted by small businesses and merchants.<ref name="jordantimes" />

| |

| |- | | |- |

| |{{flag|Lebanon}}{{anchor|Lebanon}} | | |黎巴嫩 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----The government of Lebanon has issued a warning discouraging the use of bitcoin and other similar systems.<ref name="disco" /> | | ----黎巴嫩政府发出警告,不鼓励使用比特币和其他类似系统。 |

| |- | | |- |

| |{{flag|Turkey}}{{anchor|Turkey}} | | |土耳其 |

| |[[文件:Yes_check.svg|15x15像素]] Legal / [[文件:X_mark.svg|17x17像素]] 不合法 as a payment tool, banking ban | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行禁止作为支付工具 |

| ----On 16 April 2021, [[Central Bank of the Republic of Turkey]] issued a regulation banning the use of cryptocurrencies including bitcoin and other such digital assets based on distributed ledger technology, directly or indirectly, to pay for goods and services, citing possible "irreparable" damage and transaction risks starting 30 April 2021.<ref name="TRBanPayment">{{cite press release|title=ÖDEMELERDE KRİPTO VARLIKLARIN KULLANILMAMASINA DAİR YÖNETMELİK|url=https://www.resmigazete.gov.tr/eskiler/2021/04/20210416-4.htm|date=16 April 2021|publisher=Central Bank of the Republic of Turkey|access-date=16 April 2021}}</ref><ref>{{cite news|last1=Toksabay|first1=Ece|title=Bitcoin tumbles after Turkey bans crypto payments citing risks|url=https://www.reuters.com/technology/turkey-bans-use-cryptocurrencies-payments-sends-bitcoin-down-2021-04-16/|access-date=16 April 2021|work=Reuters|date=16 April 2021|archive-date=16 April 2021|archive-url=https://web.archive.org/web/20210416062647/https://www.reuters.com/technology/turkey-bans-use-cryptocurrencies-payments-sends-bitcoin-down-2021-04-16/|url-status=live}}</ref> | | ----2021年4月16日,土耳其共和国中央银行发布了一项法规,禁止直接或间接使用包括比特币在内的所有基于分布式账本技术的加密货币,用于支付商品和服务。该法规指出可能造成的“无法弥补的”损害和交易风险,并于2021年4月30日生效。 |

| |- | | |- |

| |{{flag|Qatar}}{{anchor|Qatar}} | | |卡塔尔 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----Banks are not allowed to trade in bitcoin due to concerns over financial crimes and hacking. Additionally cryptocurrency is banned in the [[Qatar Financial Centre]].<ref>{{cite web|url=https://thepeninsulaqatar.com/article/07/02/2018/Bitcoin-trading-prohibited-in-Qatar-Central-Bank|title=Bitcoin trading prohibited in Qatar: Central Bank|date=7 February 2018|access-date=25 March 2021|website=thepeninsulaqatar.com|archive-date=6 February 2021|archive-url=https://web.archive.org/web/20210206085259/https://thepeninsulaqatar.com/article/07/02/2018/Bitcoin-trading-prohibited-in-Qatar-Central-Bank|url-status=live}}</ref> | | ----在卡塔尔,由于对金融犯罪和黑客攻击的担忧,银行不被允许交易比特币。此外,加密货币在卡塔尔金融中心也被禁止使用。 |

| |- | | |- |

| |{{flag|Iran}}{{anchor|Iran}} | | |伊朗 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----Financial institutions are not allowed by central bank to facilitate bitcoin transactions.<ref name="RCAWJune2018LOC" /> In April 2018, [[Central Bank of the Islamic Republic of Iran]] issued a statement banning the country's banks and financial institutions from dealing with cryptocurrencies, citing money laundering and terrorism financing risks.<ref>{{cite news|title=Iran central bank bans cryptocurrency dealings|url=https://www.reuters.com/article/us-crypto-currencies-iran/iran-central-bank-bans-cryptocurrency-dealings-idUSKBN1HT0YN|work=Reuters|date=22 April 2018|language=en|access-date=22 June 2023|archive-date=22 June 2023|archive-url=https://web.archive.org/web/20230622001841/https://www.reuters.com/article/us-crypto-currencies-iran/iran-central-bank-bans-cryptocurrency-dealings-idUSKBN1HT0YN|url-status=live}}</ref> | | ----伊朗伊斯兰共和国中央银行禁止该国的银行和金融机构处理加密货币交易,原因是担心可能涉及洗钱和资助恐怖主义活动的风险。 |

| |} | | |} |

|

| |

|

| ==== South Asia ==== | | ==== 南亚 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|Bangladesh}}{{anchor|Bangladesh}} | | |孟加拉国 |

| |[[文件:X_mark.svg|17x17像素]] 不合法 | | |[[文件:X_mark.svg|17x17像素]] 不合法 |

| ----Financial institutions are not allowed to facilitate bitcoin transactions.<ref name="RCAWJune2018LOC" /> In September 2014, [[Bangladesh Bank]] said that "anybody caught using the virtual currency could be jailed under the country's strict anti-money laundering laws".<ref name="bangla">{{cite web|url=https://www.telegraph.co.uk/finance/currency/11097208/Why-Bangladesh-will-jail-Bitcoin-traders.html|archive-url=https://ghostarchive.org/archive/20220112/https://www.telegraph.co.uk/finance/currency/11097208/Why-Bangladesh-will-jail-Bitcoin-traders.html|archive-date=12 January 2022|url-access=subscription|url-status=live|title=Why Bangladesh will jail Bitcoin traders|publisher=The Telegraph|work=telegraph.co.uk|date=15 September 2014|access-date=23 February 2015|author=AFP}}{{cbignore}}</ref> In 2021 the Bangladesh Bank said that cryptocurrency transactions or trade should be deemed as crimes if they involve money laundering or terror financing.<ref name="BangladeshCentralBank">{{cite web|url=https://archive.dhakatribune.com/business/2021/07/27/bangladesh-bank-to-cid-trading-owning-cryptocurrency-not-illegal|url-access=|title=Bangladesh Bank to CID: Trading, owning cryptocurrency not illegal|publisher=[[Dhaka Tribune]]|work=dhakatribune.com|date=27 July 2021|access-date=30 January 2023|author=|archive-date=30 January 2023|archive-url=https://web.archive.org/web/20230130103913/https://archive.dhakatribune.com/business/2021/07/27/bangladesh-bank-to-cid-trading-owning-cryptocurrency-not-illegal|url-status=live}}</ref> | | ----孟加拉国银行在2014年9月表示,根据该国严格的反洗钱法律,任何使用虚拟货币的人可能会被监禁。2021年,孟加拉国银行表示,如果涉及洗钱或恐怖融资,加密货币交易或贸易应被视为犯罪行为。 |

| |- | | |- |

| |{{flag|India}}{{anchor|India}} | | |印度 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Finance minister Arun Jaitley, in his budget speech on 1 February 2018, stated that the government will do everything to discontinue the use of bitcoin and other virtual currencies in India for criminal uses. He reiterated that India does not recognise them as legal tender and will instead encourage blockchain technology in payment systems. | | ----印度财政部长阿伦·贾特利在2018年2月1日的预算演讲中表示,政府将尽一切努力阻止比特币和其他虚拟货币在印度的非法使用。他重申印度不将其视为法定货币,并将鼓励区块链技术在支付系统中的应用。 |

| | | 贾特利说道:“政府不承认加密货币为法定货币或硬币,并将采取一切措施消除这些加密资产在非法活动融资或支付系统中的使用。” |

| "The government does not recognise cryptocurrency as legal tender or coin and will take all measures to eliminate the use of these cryptoassets in financing illegitimate activities or as part of the payments system," Jaitley said.<ref>{{Cite news|url=https://qz.com/1195316/budget-2018-busts-bitcoin-arun-jaitley-has-just-killed-indias-cryptocurrency-party/|title=Arun Jaitley has just killed India's cryptocurrency party|last=Anand|first=Nupur|work=Quartz|access-date=1 February 2018|language=en-US|archive-date=1 February 2018|archive-url=https://web.archive.org/web/20180201074636/https://qz.com/1195316/budget-2018-busts-bitcoin-arun-jaitley-has-just-killed-indias-cryptocurrency-party/|url-status=live}}</ref>

| |

|

| |

|

| In early 2018 India's central bank, the [[Reserve Bank of India]] (RBI) announced a ban on the sale or purchase of cryptocurrency for entities regulated by RBI.<ref>{{cite news|title=India bans crypto-currency trades|url=https://www.bbc.com/news/world-asia-india-43669730|access-date=20 February 2019|work=BBC|date=6 April 2018|archive-date=21 January 2019|archive-url=https://web.archive.org/web/20190121165356/https://www.bbc.com/news/world-asia-india-43669730|url-status=live}}</ref>

| | 2018年初,印度的中央银行——印度储备银行(RBI)宣布禁止受其监管的实体进行加密货币的买卖交易。 |

|

| |

|

| In 2019, a petition has been filed by Internet and Mobile Association of India with the [[Supreme Court of India]] challenging the 合法性 of cryptocurrencies and seeking a direction or order restraining their transaction.<ref>{{Cite web|url=http://onelawstreet.com/challenge-to-cryptocurrencies/|title=Challenge to cryptocurrencies|date=17 February 2019|website=1, Law Street|language=en-US|access-date=20 February 2019|archive-date=20 February 2019|archive-url=https://web.archive.org/web/20190220181628/http://onelawstreet.com/challenge-to-cryptocurrencies/|url-status=dead}}</ref> In March 2020, the Supreme Court of India passed the verdict, revoking the RBI ban on cryptocurrency trade.<ref>{{Cite web|url=https://www.indiatoday.in/business/story/supreme-court-quashes-rbi-ban-on-cryptocurrency-1652254-2020-03-04|title=Supreme Court quashes RBI ban on cryptocurrency trade|first1=Aneesha|last1=Mathur|website=India Today|language=en|access-date=4 March 2020|archive-date=30 January 2021|archive-url=https://web.archive.org/web/20210130034029/https://www.indiatoday.in/business/story/supreme-court-quashes-rbi-ban-on-cryptocurrency-1652254-2020-03-04|url-status=live}}</ref><ref>{{Cite web|url=https://www.thequint.com/tech-and-auto/supreme-court-strikes-down-rbi-ban-on-cryptocurrency-trading-in-india|title=Supreme Court Lifts Ban on Cryptocurrency Trading in India|date=4 March 2020|website=The Quint|language=en|access-date=4 March 2020|archive-date=4 March 2020|archive-url=https://web.archive.org/web/20200304074233/https://www.thequint.com/tech-and-auto/supreme-court-strikes-down-rbi-ban-on-cryptocurrency-trading-in-india|url-status=live}}</ref>

| | 2019年,印度互联网和移动协会向印度最高法院提出请愿,挑战加密货币的合法性,并寻求法院的指令或命令以限制其交易。2020年3月,印度最高法院做出裁决,撤销了印度储备银行对加密货币交易的禁令。 |

|

| |

|

| In 2021, the government is exploring the creation of a state-backed digital currency issued by the Reserve Bank of India, while banning private ones like bitcoin.<ref>{{Cite web|url=https://www.cnbc.com/2021/01/30/the-indian-government-may-ban-cryptocurrencies-like-bitcoin.html|title=India might ban private cryptocurrencies like bitcoin and develop a national digital coin|date=30 January 2021|website=CNBC|language=en-US|access-date=6 February 2021|archive-date=5 February 2021|archive-url=https://web.archive.org/web/20210205162633/https://www.cnbc.com/2021/01/30/the-indian-government-may-ban-cryptocurrencies-like-bitcoin.html|url-status=live}}</ref>

| | 2021年,印度政府正在探索由印度储备银行发行的由国家支持的数字货币,同时禁止像比特币这样的私人数字货币。 |

|

| |

|

| At present, India neither prohibits nor allows investment in the cryptocurrency market. In 2020, the Supreme Court of India had specifically lifted the ban on cryptocurrency, which was imposed by the Reserve Bank of India.<ref>{{Cite web|url=https://www.news18.com/news/opinion/rbi-lost-case-on-cryptocurrency-in-supreme-court-it-must-stop-behaving-like-sore-loser-4196594.html|title=RBI Lost Case on Cryptocurrency in Supreme Court, It Must Stop Behaving Like Sore Loser|date=18 September 2021|access-date=24 January 2022|archive-date=24 January 2022|archive-url=https://web.archive.org/web/20220124051652/https://www.news18.com/news/opinion/rbi-lost-case-on-cryptocurrency-in-supreme-court-it-must-stop-behaving-like-sore-loser-4196594.html|url-status=live}}</ref><ref>{{Cite news|url=https://www.thehindu.com/business/future-of-cryptocurrency-in-india-continues-to-hang-in-the-balance/article34704676.ece|title=Future of cryptocurrency in India continues to hang in the balance|newspaper=The Hindu|date=2 June 2021|last1=Perumal|first1=Prashanth|access-date=24 January 2022|archive-date=24 January 2022|archive-url=https://web.archive.org/web/20220124053149/https://www.thehindu.com/business/future-of-cryptocurrency-in-india-continues-to-hang-in-the-balance/article34704676.ece|url-status=live}}</ref><ref>{{Cite web|url=https://indianexpress.com/article/technology/crypto/cryptocurrency-in-india-a-look-at-the-regulatory-journey-of-cryptocurrencies-7648767/|title=From ban to regulation, cryptocurrency's journey so far in India|date=2 February 2022|access-date=24 January 2022|archive-date=24 January 2022|archive-url=https://web.archive.org/web/20220124051648/https://indianexpress.com/article/technology/crypto/cryptocurrency-in-india-a-look-at-the-regulatory-journey-of-cryptocurrencies-7648767/|url-status=live}}</ref><ref>{{Cite web|url=https://www.moneycontrol.com/news/business/personal-finance/sc-verdict-on-cryptocurrencies-what-it-means-for-investors-5070381.html|title=SC verdict on cryptocurrencies: What it means for investors|date=25 March 2020|access-date=24 January 2022|archive-date=24 January 2022|archive-url=https://web.archive.org/web/20220124051654/https://www.moneycontrol.com/news/business/personal-finance/sc-verdict-on-cryptocurrencies-what-it-means-for-investors-5070381.html|url-status=live}}</ref> Since then the investment in cryptocurrency is considered legitimate though there is still ambiguity about the issues regarding the extent and payment of tax on the income accrued thereupon and also its regulatory regime. But it is being contemplated that the Indian Parliament will soon pass a specific law to either ban or regulate the cryptocurrency market in India.<ref>{{Cite web|url=https://www.dw.com/en/why-is-the-indian-government-cracking-down-on-cryptocurrency/a-60148889|title=Why is the Indian government cracking down on cryptocurrency? | DW | 16.12.2021|website=[[Deutsche Welle]]|access-date=24 January 2022|archive-date=28 January 2022|archive-url=https://web.archive.org/web/20220128213818/https://www.dw.com/en/why-is-the-indian-government-cracking-down-on-cryptocurrency/a-60148889|url-status=live}}</ref> Expressing his public policy opinion on the Indian [[cryptocurrency]] market to a well-known online publication, a leading [[public policy]] lawyer and Vice President of [[South Asian Association for Regional Cooperation|SAARCLAW]] (South Asian Association for Regional Co-operation in Law) [[Hemant Batra]] has said that the "cryptocurrency market has now become very big with involvement of billions of dollars in the market hence, it is now unattainable and irreconcilable for the government to completely ban all sorts of cryptocurrency and its trading and investment".<ref>{{cite web|url=https://www.mumbaiuncensored.com/2022/01/15/the-crypto-effect-framework-challenges-the-way-forward/|title=The Crypto Effect : Framework, challenges & the way forward|date=15 January 2022|access-date=24 January 2022|archive-date=24 January 2022|archive-url=https://web.archive.org/web/20220124050010/https://www.mumbaiuncensored.com/2022/01/15/the-crypto-effect-framework-challenges-the-way-forward/|url-status=live}}</ref> He mooted regulating the cryptocurrency market rather than completely banning it. He favoured following [[International Monetary Fund|IMF]] and [[Financial Action Task Force|FATF]] guidelines in this regard.

| | 目前,印度既不禁止也不允许在加密货币市场投资。2020年,印度最高法院特别解除了印度储备银行对加密货币的禁令。自那时以来,投资加密货币被视为合法,尽管对于相关税收问题的范围和支付以及其监管制度仍存在一些模糊不清。但有人认为印度议会很快将通过一项具体法律,要么禁止,要么对加密货币市场进行规范。在向一家著名在线出版物表达对印度加密货币市场的公共政策观点时,一位领先的公共政策律师兼南亚区域法律合作组织(SAARCLAW)副主席赫曼特·巴特拉表示,“加密货币市场现在已经非常庞大,涉及数十亿美元市场,因此,政府完全禁止所有形式的加密货币及其交易和投资现在已经不可行和不可调和。”他建议在这方面遵循国际货币基金组织(IMF)和金融行动特别工作组(FATF)的指导方针,规范加密货币市场。 |

| |- | | |- |

| |{{flag|Nepal}}{{anchor|Nepal}} | | |尼泊尔 |

| |[[文件:X_mark.svg|17x17像素]] 不合法 | | |[[文件:X_mark.svg|17x17像素]] 不合法 |

| ----Absolute ban.<ref name="RCAWJune2018LOC" /> The use of any cryptocurrency is 不合法 in Nepal.<ref>{{cite web|url=https://www.nrb.org.np/2020/11/%E0%A4%A8%E0%A5%87%E0%A4%AA%E0%A4%BE%E0%A4%B2%E0%A4%AE%E0%A4%BE-bitcoin-%E0%A4%B2%E0%A4%97%E0%A4%BE%E0%A4%AF%E0%A4%A4%E0%A4%95%E0%A4%BE-cryptocurrency-%E0%A4%B9%E0%A4%B0%E0%A5%81%E0%A4%95%E0%A5%8B/|title=नपालमा Bitcoin लगायतका Cryptocurrency हरको कारोबार गरन पाइनछ/पाइदन ?|trans-title=Can Bitcoin and other cryptocurrencies be used in Nepal?|language=ne|publisher=[[Nepal Rastra Bank]]|access-date=9 September 2021|archive-date=9 September 2021|archive-url=https://web.archive.org/web/20210909155341/https://www.nrb.org.np/2020/11/%E0%A4%A8%E0%A5%87%E0%A4%AA%E0%A4%BE%E0%A4%B2%E0%A4%AE%E0%A4%BE-bitcoin-%E0%A4%B2%E0%A4%97%E0%A4%BE%E0%A4%AF%E0%A4%A4%E0%A4%95%E0%A4%BE-cryptocurrency-%E0%A4%B9%E0%A4%B0%E0%A5%81%E0%A4%95%E0%A5%8B/|url-status=live}}</ref> | | ----尼泊尔实施了绝对禁令,任何加密货币的使用都是非法的。 |

| |- | | |- |

| |{{flag|Pakistan}}{{anchor|Pakistan}} | | |巴基斯坦 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Cryptocurrencies including bitcoin are not officially regulated in Pakistan;<ref>{{Cite news|last=Tanoli|first=Ishaq|date=18 December 2020|title=State Bank never declared cryptocurrency illegal, SHC told|work=Dawn|url=https://www.techjuice.pk/crypto-to-be-legalized-in-pakistan-if-the-government-fails-to-reply-to-waqar-zakas-petition/|access-date=|archive-date=22 January 2021|archive-url=https://web.archive.org/web/20210122022614/https://www.techjuice.pk/crypto-to-be-legalized-in-pakistan-if-the-government-fails-to-reply-to-waqar-zakas-petition/|url-status=live}}</ref><ref>{{Cite news|last=Khurshid|first=Jamal|date=18 December 2020|title=SBP did not declare crypto currency illegal, SHC told|work=TheNews|url=https://www.thenews.com.pk/print/760471-sbp-did-not-declare-crypto-currency-illegal-shc-told|access-date=|archive-date=22 January 2021|archive-url=https://web.archive.org/web/20210122022617/https://www.thenews.com.pk/print/760471-sbp-did-not-declare-crypto-currency-illegal-shc-told|url-status=live}}</ref> however, it is not 不合法 or banned. As of 16 January 2021, the State Bank of Pakistan has not authorized any individuals or organizations to carry out the sale, purchase, exchange, and investment of virtual currencies, coins, and tokens.<ref>{{Cite web|last=|first=|date=2018|title=CAUTION REGARDING RISKS OF VIRTUAL CURRENCIES|url=https://www.sbp.org.pk/warnings/pdf/2018/PBNT-VC.pdf|access-date=|website=|archive-date=6 March 2021|archive-url=https://web.archive.org/web/20210306144012/https://www.sbp.org.pk/warnings/pdf/2018/PBNT-VC.pdf|url-status=live}}</ref> There have been a number of arrests by the Cyber Crime Wing of the Federal Investigation Agency (FIA) related to the mining of bitcoin and other cryptocurrencies. These arrests were made under money-laundering charges.<ref>{{Cite news|last=|first=|date=23 January 2020|title=Two held in Shangla for money laundering through bitcoin|work=Dawn|url=https://www.dawn.com/news/1529970|access-date=|archive-date=23 January 2021|archive-url=https://web.archive.org/web/20210123004325/https://www.dawn.com/news/1529970|url-status=live}}</ref> | | ----巴基斯坦并未正式对加密货币(包括比特币)进行监管,但也没有明文规定其为非法或禁止。截至2021年1月16日,巴基斯坦国家银行尚未授权任何个人或组织进行虚拟货币、代币和数字资产的销售、购买、交换和投资。巴基斯坦联邦调查局(FIA)的网络犯罪调查部门曾因涉及挖掘比特币和其他加密货币而进行多起逮捕,这些逮捕行动是基于洗钱指控进行的。 |

|

| |

|

| Despite the many controversies around virtual currencies, prominent Pakistani bloggers and social media influencers are publicly involved in trading bitcoin and regularly publish content on social media in the favor of regulating cryptocurrencies. In December 2020, the Khyber Pakhtunkhwa government became the first province in Pakistan to pass a resolution to legalize cryptocurrency in the country.<ref>{{Cite news|last=|first=|date=3 December 2020|title=KP Government Legalizes Cryptocurrency: Zia Ullah Bangash|work=Business Recorder|url=https://www.brecorder.com/news/40037203/kp-government-legalizes-cryptocurrency-zia-ullah-bangash|access-date=|archive-date=21 January 2021|archive-url=https://web.archive.org/web/20210121222921/https://www.brecorder.com/news/40037203/kp-government-legalizes-cryptocurrency-zia-ullah-bangash|url-status=live}}</ref>

| | 尽管围绕虚拟货币存在许多争议,但一些知名的巴基斯坦博主和社交媒体影响者公开参与比特币交易,并经常在社交媒体上发布有利于加密货币监管的内容。2020年12月,巴基斯坦开伯尔-普赫图赫瓦省成为该国第一个通过决议支持在全国范围内合法化加密货币的省份。 |

| |} | | |} |

|

| |

|

| ==== East Asia ==== | | ==== 东亚 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|China}} (PRC){{anchor|China}} | | |中华人民共和国 |

| |[[文件:X_mark.svg|17x17像素]] 不合法 | | |[[文件:X_mark.svg|17x17像素]] 不合法 |

| ----Financial institutions are not allowed to facilitate bitcoin transactions.<ref name="RCAWJune2018LOC" /> Regulation prohibits financial firms holding or trading cryptocurrencies.{{r|"EUPARANNEX"|page=China}} On 5 December 2013, [[People's Bank of China]] (PBOC) made its first step in regulating bitcoin by prohibiting financial institutions from handling bitcoin transactions.<ref name="Bloomberd">{{cite news|url=https://www.bloomberg.com/news/2013-12-05/china-s-pboc-bans-financial-companies-from-bitcoin-transactions.html|title=China Bans Financial Companies From Bitcoin Transactions|newspaper=Bloomberg.com|publisher=Bloomberg|date=5 December 2013|access-date=16 December 2013|archive-date=7 January 2015|archive-url=https://web.archive.org/web/20150107224952/http://www.bloomberg.com/news/2013-12-05/china-s-pboc-bans-financial-companies-from-bitcoin-transactions.html|url-status=live}}</ref> | | ----中国人民银行自2013年12月5日起,首次对比特币进行监管,禁止金融机构处理比特币交易。 |

|

| |

|

| On 1 April 2014 PBOC ordered commercial banks and payment companies to close bitcoin trading accounts in two weeks.<ref name="wsj4-2014">{{cite news|author1=Chao Deng|author2=Lingling Wei|title=China Cracks Down on Bitcoin|url=https://online.wsj.com/articles/SB10001424052702304157204579475233879506454|access-date=8 November 2014|work=WSJ.com|publisher=Dow Jones & Company|date=1 April 2014|archive-date=27 March 2020|archive-url=https://web.archive.org/web/20200327144736/https://online.wsj.com/articles/SB10001424052702304157204579475233879506454|url-status=live}}</ref>

| | 2014年4月1日,中国人民银行要求商业银行和支付公司在两周内关闭比特币交易账户。 |

|

| |

|

| Cryptocurrency exchanges or trading platforms were effectively banned by regulation in September 2017 with 173 platforms closed down by July 2018.<ref name="LOC2018China">{{cite web|title=Regulation of Cryptocurrency: C`|url=https://www.loc.gov/law/help/cryptocurrency/china.php|website=Library of Congress|access-date=29 September 2018|date=12 July 2018|archive-date=29 September 2018|archive-url=https://web.archive.org/web/20180929080014/http://www.loc.gov/law/help/cryptocurrency/china.php|url-status=live}}</ref>

| | 2017年9月,通过法规禁止加密货币交易所或交易平台运营,到2018年7月关闭了173家平台。 |

|

| |

|

| In early 2018 the [[People's Bank of China]] announced the [[State Administration of Foreign Exchange]] led by [[Pan Gongsheng]] would crack down on bitcoin mining.<ref name="techcrunchBTC">{{cite news|last1=Russell|first1=John|title=China is reportedly moving to clamp down on bitcoin miners|url=https://techcrunch.com/2018/01/08/china-is-reportedly-moving-to-clampdown-on-bitcoin-miners/|access-date=10 January 2018|work=TechCrunch|date=9 January 2018|archive-date=10 January 2018|archive-url=https://web.archive.org/web/20180110174448/https://techcrunch.com/2018/01/08/china-is-reportedly-moving-to-clampdown-on-bitcoin-miners/|url-status=live}}</ref><ref name="ChinaDaily20180105">{{cite news|last1=Chen|first1=Jia|title=PBOC gets tougher on bitcoin|url=http://www.chinadaily.com.cn/a/201801/05/WS5a4eb4cba31008cf16da527c.html|access-date=10 January 2018|work=China Daily|date=5 January 2018|archive-date=10 January 2018|archive-url=https://web.archive.org/web/20180110000244/http://www.chinadaily.com.cn/a/201801/05/WS5a4eb4cba31008cf16da527c.html|url-status=live}}</ref> Many bitcoin mining operations in China had stopped operating by January 2018.<ref name="LOC2018China" /> A complete ban on cryptocurrency trading and mining was put into effect on 24 September 2021.<ref>{{cite news|last1=John|first1=Alun|last2=Shen|first2=Samuel|last3=Wilson|first3=Tom|title=China's top regulators ban crypto trading and mining, sending bitcoin tumbling|url=https://www.reuters.com/world/china/china-central-bank-vows-crackdown-cryptocurrency-trading-2021-09-24/|access-date=24 September 2021|work=Reuters|date=24 September 2021|language=en|archive-date=20 September 2022|archive-url=https://web.archive.org/web/20220920005038/https://www.reuters.com/world/china/china-central-bank-vows-crackdown-cryptocurrency-trading-2021-09-24/|url-status=live}}</ref>

| | 2018年初,中国人民银行宣布由国家外汇管理局领导的行动将打击比特币挖矿,到2018年1月,许多比特币挖矿操作已经停止。 |

| | |

| | 2021年9月24日,全面禁止加密货币交易和挖矿。 |

| |- | | |- |

| |{{flag|Hong Kong}}{{anchor|Hong Kong}} | | |香港 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----In 2013 [[Norman Chan]], the chief executive of [[Hong Kong Monetary Authority]] (HKMA) said that bitcoin is only a virtual commodity. He also decided that bitcoin will not be regulated by HKMA. However, the authority will be closely watching the usage of bitcoin locally and its development overseas.<ref>{{cite news|title=比特币不受金管局监管 (Bitcoin is not regulated by HKMA)|url=http://news.takungpao.com/paper/q/2013/1116/2042791.html|date=16 November 2013|publisher=[[Ta Kung Pao]]|access-date=18 January 2014|archive-date=27 October 2016|archive-url=https://web.archive.org/web/20161027014238/http://news.takungpao.com/paper/q/2013/1116/2042791.html|url-status=live}}</ref>[[Secretary for Financial Services and the Treasury]] addressed bitcoin in the [[Legislative Council of Hong Kong|Legislative Council]] stating that "Hong Kong at present has no legislation directly regulating bitcoins and other virtual currencies of [a] similar kind. However, our existing laws (such as the Organised and Serious Crimes Ordinance) provide sanctions against unlawful acts involving bitcoins, such as fraud or money laundering."{{r|"regulation"|page=Hong Kong}} | | ----2013年,香港金融管理局(HKMA)行政总裁陈德霖表示,比特币仅为虚拟商品,并决定不对其进行监管。然而,该机构将密切关注比特币在本地及海外的使用和发展。财经事务及库务局局长在立法会上提到,“香港目前没有直接管理比特币及其他类似虚拟货币的法律。然而,我们现有的法律(如有组织及严重罪行条例)对涉及比特币的非法行为,如欺诈或洗钱,提供制裁。” |

|

| |

|

| Starting in late 2022 government bodies including the Treasury Bureau and the HKMA announced they intended to embrace digital assets, and began work on a regulatory framework based on the idea of “same activity, same risks, same regulation”.<ref>{{Cite web|date=2022-11-08|title=Hong Kong’s renewed stance on virtual assets, security tokens and retail investors {{!}} Davis Polk|url=https://www.davispolk.com/insights/client-update/hong-kongs-renewed-stance-virtual-assets-security-tokens-and-retail|access-date=2024-06-03|website=www.davispolk.com|language=en}}</ref><ref>{{Cite web|last=Authority|first=Hong Kong Monetary|title=Hong Kong Monetary Authority - New Fintech Promotion Roadmap: Opening Remarks at the Seminar on Distributed Ledger Technology - Unlocking the Potential of DLT in Financial Services|url=https://www.hkma.gov.hk/eng/news-and-media/speeches/2024/03/20240327-1/|access-date=2024-06-10|website=Hong Kong Monetary Authority|language=en}}</ref><ref>{{Cite web|title=Financial Services and the Treasury Bureau : A new phase in virtual asset regulation|url=https://www.fstb.gov.hk/en/blog/blog020224.htm|access-date=2024-06-10|website=www.fstb.gov.hk|language=en}}</ref><ref>{{Cite web|date=2023-07-23|title=Ripple focused on markets with clear rules as ambiguity remains in US after win|url=https://www.scmp.com/tech/tech-trends/article/3228489/crypto-firm-ripple-focused-markets-clear-rules-including-asia-after-partial-us-victory-allowing-xrp|access-date=2024-06-10|website=South China Morning Post|language=en}}</ref> By late 2023 a supervision framework that includes enhanced identity verification was finalized.<ref>{{Cite web|last=Standard|first=The|title=Crypto oversight won't hurt market: Chan|url=https://www.thestandard.com.hk/section-news/section/2/257427/Crypto-oversight-won't-hurt-market:-Chan|access-date=2024-06-03|website=The Standard|language=en}}</ref> The new Virtual Asset Trading Plaftorm regulations came into force mid-2024.<ref>{{Cite web|date=2024-02-05|title=Hong Kong wants crypto investors to remain wary as exchanges rush for licence|url=https://www.scmp.com/tech/policy/article/3250996/sfc-reminds-crypto-investors-be-wary-unlicensed-platforms-final-month-apply-under-hong-kong-scheme|access-date=2024-06-03|website=South China Morning Post|language=en}}</ref>

| | 从2022年底开始,包括财政司和香港金融管理局在内的政府部门宣布他们打算拥抱数字资产,并开始制定基于“同一活动、同一风险、同一监管”的监管框架。到2023年底,包括增强身份验证在内的监管框架最终确定。新的虚拟资产交易平台规定于2024年中期生效。 |

| |- | | |- |

| |{{flag|Japan}}{{anchor|Japan}} | | |日本 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----On 7 March 2014, the Japanese government, in response to a series of questions asked in the [[National Diet]], made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions.<ref>{{cite news|url=http://www.nikkei.com/article/DGXNASGC0700C_X00C14A3MM0000/|work=Nikkei Inc.|title=The First Governmental View: Bitcoin is not Currency (in Japanese)|date=7 March 2014|access-date=28 March 2014|archive-date=2 April 2019|archive-url=https://web.archive.org/web/20190402115949/https://www.nikkei.com/article/DGXNASGC0700C_X00C14A3MM0000/|url-status=live}}</ref> The decision did not see bitcoin as currency nor bond under the current Banking Act and Financial Instruments and Exchange Law, prohibiting banks and securities companies from dealing in bitcoins. The decision also acknowledges that there are no laws to unconditionally prohibit individuals or legal entities from receiving bitcoins in exchange for goods or services. Taxes may be applicable to bitcoins. | | ----2014年3月7日,日本政府在国会提出的一系列问题中作出了关于比特币法律处理的内阁决定。该决定认为比特币不属于货币或债券,因此禁止银行和证券公司交易比特币。决定还承认,目前没有法律无条件禁止个人或法人以比特币交换商品或服务。比特币可能需要缴纳税款。 |

|

| |

|

| As of April 2017, cryptocurrency exchange businesses operating in Japan have been regulated by the Payment Services Act. Cryptocurrency exchange businesses have to be registered, keep records, take security measures, and take measures to protect customers. The law on cryptocurrency transactions must comply with the anti-money laundering law; and measures to protect users investors. The Payment Services Act defines "cryptocurrency" as a property value. The Act also states that cryptocurrency is limited to property values that are stored electronically on electronic devices, not a legal tender.<ref>{{cite web|title=Regulation of Cryptocurrency|url=https://www.loc.gov/law/help/cryptocurrency/japan.php|publisher=Library of Congress|access-date=7 September 2018|language=en|date=June 2018|archive-date=21 September 2018|archive-url=https://web.archive.org/web/20180921031724/http://www.loc.gov/law/help/cryptocurrency/japan.php|url-status=live}} {{PD-notice}}</ref><ref>{{Cite news|title=ADVISORY-References to bitcoin as 'legal tender' in Japan|url=https://www.reuters.com/article/idUKL3N1OD35L|publisher=[[Reuters]]|date=13 December 2017|access-date=6 June 2021|archive-date=6 June 2021|archive-url=https://web.archive.org/web/20210606011252/https://www.reuters.com/article/idUKL3N1OD35L|url-status=live}}</ref>

| | 截至2017年4月,日本的加密货币交易业务受到支付服务法的监管。加密货币交易业务必须注册,保留记录,采取安全措施,并保护客户。支付服务法将“加密货币”定义为一种财产价值。该法案还规定,加密货币只限于存储在电子设备上的电子形式财产价值,而非法定货币。 |

| |- | | |- |

| |{{flag|South Korea}}{{anchor|South Korea}} | | |韩国 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Minors and all foreigners are prohibited from trading cryptocurrencies. Adult South Koreans may trade on registered exchanges using ''real name'' accounts at a bank where the exchange also has an account. Both the bank and the exchange are responsible for verifying the customer's identity and enforcing other anti-money-laundering provisions.<ref name="LOCJune2018">{{cite web|title=Regulation of Cryptocurrency Around the World|url=https://www.loc.gov/law/help/cryptocurrency/cryptocurrency-world-survey.pdf|website=Library of Congress|access-date=29 September 2018|date=June 2018|archive-date=14 August 2018|archive-url=https://web.archive.org/web/20180814071440/https://www.loc.gov/law/help/cryptocurrency/cryptocurrency-world-survey.pdf|url-status=live}}</ref><ref>{{cite web|author1=Brian Newar|title=Amendment to Special Reporting Act Passes – Cryptocurrency Now Fully Legal in South Korea|url=https://thenews.asia/amendment-to-special-reporting-act-passes-cryptocurrency-trading-now-legal-in-south-korea/|website=TheNews.Asia|date=5 March 2020|access-date=16 July 2020|archive-date=10 February 2021|archive-url=https://web.archive.org/web/20210210021013/https://thenews.asia/amendment-to-special-reporting-act-passes-cryptocurrency-trading-now-legal-in-south-korea/|url-status=live}}</ref> | | ----韩国的加密货币交易规定如下:未成年人和所有外国人禁止交易加密货币。成年韩国公民可以在注册的交易所上,通过与交易所有账户的银行开设真实姓名账户来进行交易。银行和交易所都有责任验证客户身份,并执行其他反洗钱规定。 |

| |- | | |- |

| |{{flag|Taiwan|name=Taiwan}}{{anchor|Taiwan}} | | |台湾 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----Financial institutions are not allowed to facilitate bitcoin transactions.<ref name="RCAWJune2018LOC" /> Regulators have warned the public that bitcoin does not have legal protection, "as the currency is not issued by any monetary authority and is therefore not entitled to legal claims or guarantee of conversion".<ref>{{cite web|last1=Hsu|first1=Crystal|title=Regulators warn against using bitcoins|url=http://www.taipeitimes.com/News/biz/archives/2013/12/31/2003580146|website=Taipei Times|date=31 December 2013|access-date=17 April 2017|archive-date=15 December 2018|archive-url=https://web.archive.org/web/20181215123107/http://www.taipeitimes.com/News/biz/archives/2013/12/31/2003580146|url-status=live}}</ref> | | ----台湾地区监管机构对于比特币採取严格管制,明确禁止金融机构协助比特币交易。同时,监管部门也一再提醒民众,比特币并非由国家或央行发行,不具有法币地位,因此没有法律保障。如金融机构涉及比特币业务,将面临监管处罚。 |

|

| |

|

| Financial institutions have been warned by regulators that necessary regulatory actions may be taken if they use bitcoin.{{r|"regulation"|page=Taiwan}}

| | 2013 年底,台湾金融监管部门联合央行发布联合声明,警告民众比特币风险,强调其高波动性、投机性以及缺乏法律保障。2014年 1 月,监管部门负责人明确表示,由于比特币并非法定货币,将禁止在台湾安装比特币 ATM 机。 |

| | |

| On 31 December 2013, [[Financial Supervisory Commission (Republic of China)]] (FSC) and CBC issued a joint statement which warns against the use of bitcoin. It is stated that bitcoin remains highly volatile, highly speculative, and is not entitled to legal claims or guarantee of conversion.<ref>{{cite news|last1=Crystal|first1=Hsu|title=Regulators warn against using bitcoins|url=http://www.taipeitimes.com/News/biz/archives/2013/12/31/2003580146|access-date=15 October 2015|publisher=[[Taipei Times]]|date=31 December 2013|archive-date=15 December 2018|archive-url=https://web.archive.org/web/20181215123107/http://www.taipeitimes.com/News/biz/archives/2013/12/31/2003580146|url-status=live}}</ref>

| |

| | |

| On 5 January 2014, FSC chairman [[Tseng Ming-chung]] stated that FSC will not allow the installation of bitcoin ATM in Taiwan because bitcoin is not a currency and it should not be accepted by individuals and banks as payment.<ref>{{cite news|title=Taiwan's Government Says No To Bitcoin ATMs|url=https://techcrunch.com/2014/01/05/taiwans-government-says-no-to-bitcoin-atms/|date=5 January 2014|last=Shu|first=Catherine|publisher=[[TechCrunch]]|access-date=18 January 2014|archive-date=24 June 2019|archive-url=https://web.archive.org/web/20190624170514/https://techcrunch.com/2014/01/05/taiwans-government-says-no-to-bitcoin-atms/|url-status=live}}</ref>

| |

| |} | | |} |

|

| |

|

| ==== Southeast Asia ==== | | ==== 东南亚 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|Cambodia}}{{anchor|Cambodia}} | | |柬埔寨 |

| |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 | | |[[文件:Yes_check.svg|15x15像素]] 合法 / [[文件:X_mark.svg|17x17像素]] 央行不鼓励使用 |

| ----The National Bank of Cambodia (NBC), has "asked banks in Cambodia not to allow people to conduct transactions with cryptocurrencies."<ref name="RCAWJune2018LOC" /> | | ----柬埔寨国家银行(NBC)要求柬埔寨银行不允许人们使用加密货币进行交易。 |

| |- | | |- |

| |{{flag|Indonesia}}{{anchor|Indonesia}} | | |印度尼西亚 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to trade and hold / [[文件:X_mark.svg|17x17像素]] 不合法 as payment tool | | |[[文件:Yes_check.svg|15x15像素]] 持有及交易合法 / [[文件:X_mark.svg|17x17像素]] 央行禁止作为支付工具 |

| ----On 7 December 2017, [[Bank Indonesia]], the country's central bank, issued a regulation banning the use of cryptocurrencies including bitcoin as payment tools starting 1 January 2018.<ref name="RCAWJune2018LOC" /> On 11 November 2021, [[Indonesian Ulema Council]] issued ''[[haram]]'' [[fatwa]] against use of cryptocurrencies as currency including Bitcoin, citing both Islamic laws and Indonesian banking and monetary regulations. The fatwa also forbids cryptocurrency trading and holding, except if those cryptocurrencies met the Islamic ''sil'ah'' standards of trade-able and own-able goods such as having physical form, having clear value, having known number, can be really owned, transferable, and not entirely speculative.<ref>{{Cite web|last=Hikam|first=Herdi Alif Al|date=11 November 2021|title=MUI: Kripto Sebagai Mata Uang Hukumnya Haram!|url=https://finance.detik.com/fintech/d-5806788/mui-kripto-sebagai-mata-uang-hukumnya-haram|access-date=11 November 2021|website=detikfinance|language=id-ID|archive-date=11 November 2021|archive-url=https://web.archive.org/web/20211111082327/https://finance.detik.com/fintech/d-5806788/mui-kripto-sebagai-mata-uang-hukumnya-haram|url-status=live}}</ref> By passing of the [[Law on Financial Sector Development and Strengthening]] on 15 December 2022, all cryptocurrencies including the Bitcoin listed as "monitored financial technologies" that all related affairs related to the innovation, utilization, and other activities related to it will become the subject of Bank Indonesia and [[Financial Services Authority (Indonesia)|Financial Services Authority]] control and monitoring.<ref>{{Cite web|date=2022-12-16|title=Mengenal UU PPSK, Omnibus Law Keuangan yang Juga Mengatur Aset Kripto - Sejarah Ekonomi Katadata.co.id|url=https://katadata.co.id/ariayudhistira/ekonopedia/639be5a811279/mengenal-uu-ppsk-omnibus-law-keuangan-yang-juga-mengatur-aset-kripto|access-date=2022-12-17|website=katadata.co.id|language=id|archive-date=17 December 2022|archive-url=https://web.archive.org/web/20221217041314/https://katadata.co.id/ariayudhistira/ekonopedia/639be5a811279/mengenal-uu-ppsk-omnibus-law-keuangan-yang-juga-mengatur-aset-kripto|url-status=live}}</ref> | | ----印度尼西亚的中央银行,于2017年12月7日发布了一项法规,从2018年1月1日起禁止使用比特币等加密货币作为支付工具。2021年11月11日,印度尼西亚伊斯兰法学会发布了一项关于加密货币的哈拉姆法令,禁止将加密货币作为货币使用,包括比特币,理由是违反伊斯兰法和印度尼西亚银行和货币法规。该法令还禁止加密货币的交易和持有,除非这些加密货币符合伊斯兰教的贸易标准,如具有实体形式、具有清晰价值、已知数量、可以真正拥有、可转让且不完全是投机性的。通过2022年12月15日颁布的《金融部门发展和加强法》中,所有包括比特币在内的加密货币被列为“受监控的金融技术”,所有与创新、利用及其他相关活动有关的事务将受到印度尼西亚国家银行和金融服务管理局的控制和监测。 |

| |- | | |- |

| |{{flag|Malaysia}}{{anchor|Malaysia}} | | |马来西亚 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----On 4 November 2013, [[Bank Negara Malaysia]] (BNM) met with local bitcoin proponents to learn more about the currency but did not comment at the time.<ref>{{cite web|url=http://betanomics.asia/blog/bank-negara-malaysian-government-unoffical-bitcoin-statement|title=Bank Negara's Officially Unofficial Statement on Bitcoin is No Statement|publisher=Betanomics.asia|access-date=21 September 2014|archive-date=4 September 2014|archive-url=https://web.archive.org/web/20140904192251/http://betanomics.asia/blog/bank-negara-malaysian-government-unoffical-bitcoin-statement|url-status=live}}</ref> BNM issued a statement on 6 January 2014 that bitcoin is not recognised as a legal tender in [[Malaysia]]. The central bank will not regulate bitcoin operations at the moment and users should aware of the risks associated with bitcoin usage.<ref>{{cite news|title=Statement on Bitcoin|url=http://www.bnm.gov.my/index.php?ch=en_announcement&pg=en_announcement_all&ac=275|date=6 January 2014|publisher=[[Bank Negara Malaysia]]|access-date=2 March 2014|archive-date=17 July 2018|archive-url=https://web.archive.org/web/20180717100240/http://www.bnm.gov.my/index.php?ch=en_announcement&pg=en_announcement_all&ac=275|url-status=dead}}</ref><ref>{{cite news|title=BNM warns on Bitcoin risks|url=http://www.theedgemalaysia.com/technology/270011-bnm-warns-on-bitcoin-risks.html|archive-url=https://archive.today/20140111000422/http://www.theedgemalaysia.com/technology/270011-bnm-warns-on-bitcoin-risks.html|url-status=dead|archive-date=11 January 2014|date=6 January 2014|last=Fuad|first=Madiha|publisher=[[The Edge (Malaysia)]]|access-date=11 January 2014}}</ref>{{r|"regulation"|page=Malaysia}} | | ----2013 年 11 月 4 日,马来西亚国家银行 (BNM) 与当地比特币支持者会面,以了解更多有关该货币的信息,但当时并未发表评论。2014 年 1 月 6 日,马来西亚国家银行发布声明称,比特币在马来西亚不被视为法定货币。央行目前不会监管比特币业务,用户应意识到使用比特币的风险。 |

| |- | | |- |

| |{{flag|Philippines}}{{anchor|Philippines}} | | |菲律宾 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----On 6 March 2014, [[Bangko Sentral ng Pilipinas]] (BSP) issued a statement on risks associated with bitcoin trading and usage. Recently virtual currencies were legalized and cryptocurrency exchanges are now regulated by Central Bank of the Philippines (Bangko Sentral ng Pilipinas) under Circular 944; however bitcoin and other "virtual currencies" are not recognized by the BSP as currency as "it is neither issued or guaranteed by a central bank nor backed by any commodity."<ref>{{Cite web|url=http://www.bsp.gov.ph/downloads/regulations/attachments/2017/c944.pdf|title=Guidelines for Virtual Currency (VC) Exchanges — BSP Circular 944 Series of 2017|last=Espenilla, Jr.|first=Nestor|date=6 February 2017|website=Bangko Sentral ng Pilipinas (Central Bank of the Philippines)|access-date=7 May 2017|archive-date=16 May 2017|archive-url=https://web.archive.org/web/20170516190637/http://www.bsp.gov.ph/downloads/regulations/attachments/2017/c944.pdf|url-status=live}}</ref> | | ----2014年3月6日,菲律宾央行(Bangko Sentral ng Pilipinas,BSP)发布了一份关于比特币交易和使用风险的声明。尽管最近菲律宾央行根据《Circular 944》对加密货币交易所进行了合法化和监管,但比特币和其他“虚拟货币”并未被菲律宾央行视为法定货币。菲律宾央行认为,这些货币既不由中央银行发行或保证,也没有任何商品作为支持。 |

| |- | | |- |

| |{{flag|Singapore}}{{anchor|Singapore}} | | |新加坡 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----In December 2013, the [[Monetary Authority of Singapore]] reportedly stated that "[w]hether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene."{{r|"regulation"|page=Singapore}} | | ----据报道,2013年12月,新加坡金融管理局表示,“企业是否接受比特币以换取其商品和服务是一项商业决定,新加坡金管局不予干预。 |

| | | 2013 年 9 月 22 日,新加坡金融管理局 (MAS) 警告用户使用比特币的相关风险,称“如果比特币停止运营,可能没有可识别的一方负责退还他们的款项或让他们寻求追索权” ,并于 2013 年 12 月表示“企业是否接受比特币以换取其商品和服务是一项商业决定,MAS 不干预” 2014年1月,新加坡税务局发布了一系列税收指南,根据这些指南,如果比特币交易被用作真实商品和服务的支付方式,则可以将其视为易货交易。与比特币货币兑换打交道的企业将根据其比特币销售额征税。 |

| On 22 September 2013, the [[Monetary Authority of Singapore]] (MAS) warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse"<ref>{{cite web|author=Irene Tham|url=http://business.asiaone.com/news/bitcoin-users-beware-mas|title=Bitcoin users beware: MAS | AsiaOne Business|publisher=Business.asiaone.com|date=22 September 2013|access-date=27 December 2013|archive-url=https://web.archive.org/web/20131224094806/http://business.asiaone.com/news/bitcoin-users-beware-mas|archive-date=24 December 2013|url-status=dead}}</ref> and in December 2013 stated "Whether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene"<ref>{{cite web|author=Terence Lee|url=http://www.techinasia.com/singapore-government-decides-interfere-bitcoin/|title=Singapore government decides not to interfere with Bitcoin|publisher=Techinasia.com|date=23 December 2013|access-date=27 December 2013|archive-date=26 December 2013|archive-url=https://web.archive.org/web/20131226011048/http://www.techinasia.com/singapore-government-decides-interfere-bitcoin/|url-status=live}}</ref> In January 2014, the [[Inland Revenue Authority of Singapore]] issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Businesses that deal with bitcoin currency exchanges will be taxed based on their bitcoin sales.<ref>{{cite news|title=Singaporean Tax Authorities Have Issued Guidance On Bitcoin-Related Sales And Earnings|url=http://www.businessinsider.com.au/singaporean-tax-authorities-have-issued-guidance-on-bitcoin-related-sales-and-earnings-2014-1|date=9 January 2014|last=Tay|first=Liz|publisher=[[Business Insider|Business Insider (Australia)]]|access-date=11 January 2014|archive-date=20 September 2018|archive-url=https://web.archive.org/web/20180920133802/https://www.businessinsider.com.au/singaporean-tax-authorities-have-issued-guidance-on-bitcoin-related-sales-and-earnings-2014-1|url-status=dead}}</ref>

| | 2019 年 4 月,MAS 将比特币称为《支付服务法》中的数字支付代币。 |

| | |

| In April 2019, the MAS referred to bitcoin as a digital payment token for purposes of the [[Payment Services Act]].<ref>[https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulations-Guidance-and-Licensing/Guide-to-Digital-Tokens-Offering-last-updated-on-5-April-2019.pdf "MAS - A Guide to Digital Token Offerings" ] {{Webarchive|url=https://web.archive.org/web/20190810130901/https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulations-Guidance-and-Licensing/Guide-to-Digital-Tokens-Offering-last-updated-on-5-April-2019.pdf|date=10 August 2019}}.</ref>

| |

| |- | | |- |

| |{{flag|Thailand}}{{anchor|Thailand}} | | |泰国 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to trade and hold / [[文件:X_mark.svg|17x17像素]] 不合法 as payment tool | | |[[文件:Yes_check.svg|15x15像素]] 持有及交易合法 / [[文件:X_mark.svg|17x17像素]] 央行禁止作为支付工具 |

| ----Thai based bitcoin exchanges can only exchange Digital Currencies for Thai Baht and are required to operate with a Thailand Business Development Department e-commerce license. They are also required to have KYC and CDD policies and procedures in place, in accordance with the Ministerial Regulation Prescribing Rules and Procedures for Customer Due Diligence, Reference Page 8 Volume 129 Part 44 A Government Gazette 23 May 2555 (2012).<ref>{{Cite web|url=https://www.tgia.org/upload/file_group/18/download_225.PDF|title=Ministerial Regulation Prescribing Rules and Procedures for Customer Due Diligence|date=23 May 2012|website=Tgia.org|access-date=30 October 2017|archive-date=1 May 2015|archive-url=https://web.archive.org/web/20150501052718/http://www.tgia.org/upload/file_group/18/download_225.PDF|url-status=live}}</ref> | | ----泰国的比特币交易所只能将数字货币兑换成泰铢,并且必须持有泰国商业发展部的电子商务许可证。他们还必须根据《规定客户尽职调查规则和程序的部长条例》制定 KYC 和 CDD 政策和程序,参考第 8 页,第 129 卷,第 44 部分,政府公报。 |

| | | 可疑活动必须向反洗钱办公室报告。 |

| Suspicious activity must be reported to the [[Anti-Money Laundering Office (Thailand)|Anti-Money Laundering Office]].<ref>{{Cite web|url=http://www.amlo.go.th/index.php/en/|title=Anti Money Laundering Office Thailand|website=Amlo.go.th|access-date=29 October 2017|archive-date=11 September 2018|archive-url=https://web.archive.org/web/20180911211414/http://www.amlo.go.th/index.php/en/|url-status=live}}</ref>

| | 自 2022 年 4 月 1 日起,泰国政府不再允许将加密货币用作商品或服务的支付方式。该法规并未禁止拥有或交易加密货币,尽管商业银行已被警告不要直接参与数字资产。 |

| | |

| As of 1 April 2022, the Thai government no longer allows cryptocurrencies to be used as payment for goods or services. The regulation doesn't prohibit owning or trading cryptocurrencies, although commercial banks have been cautioned against direct involvement in digital assets.<ref>{{cite news|title=Govt bars use of cryptocurrencies as method of payment|url=https://www.bangkokpost.com/business/2283918/govt-bars-use-of-cryptocurrencies-as-method-of-payment|access-date=23 March 2022|work=[[Bangkok Post]]|agency=Bloomberg|date=23 March 2022|archive-date=1 July 2023|archive-url=https://web.archive.org/web/20230701120704/https://www.bangkokpost.com/business/2283918/govt-bars-use-of-cryptocurrencies-as-method-of-payment|url-status=live}}</ref>

| |

| |- | | |- |

| |{{flag|Vietnam}}{{anchor|Vietnam}} | | |越南 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to trade and hold / [[文件:X_mark.svg|17x17像素]] 不合法 as payment tool | | |[[文件:Yes_check.svg|15x15像素]] 持有及交易合法 / [[文件:X_mark.svg|17x17像素]] 央行禁止作为支付工具 |

| ----The State Bank of Vietnam has declared that the issuance, supply and use of bitcoin and other similar virtual currency is 不合法 as a mean of payment and subject to punishment ranging from 150 million to 200 million VND,<ref>{{Cite web|url=https://tuoitre.vn/news-20171028102135916.htm|title=Ngân hàng nhà nước tuyên bố cấm sử dụng bitcoin|first=TUOI TRE|last=ONLINE|date=28 October 2017|website=TUOI TRE ONLINE|access-date=10 June 2021|archive-date=10 June 2021|archive-url=https://web.archive.org/web/20210610115427/https://tuoitre.vn/news-20171028102135916.htm|url-status=live}}</ref> but the government does not ban bitcoin trading as a virtual goods or assets.<ref>{{Cite web|url=https://thanhnien.vn/content/NzA4Mzgz.html|title=Thanh toán, giao dịch bitcoin vẫn sôi động|date=6 November 2017|website=Báo Thanh Niên|access-date=10 June 2021|archive-date=1 July 2023|archive-url=https://web.archive.org/web/20230701120657/https://thanhnien.vn/thanh-toan-giao-dich-bitcoin-van-soi-dong-185708383.htm|url-status=live}}</ref> | | ----越南国家银行宣布,比特币和其他类似虚拟货币的发行、供应和使用作为支付手段是非法的,将受到1.5亿至2亿越南盾的处罚, 但政府并未禁止比特币作为虚拟商品或资产进行交易。 |

| |- | | |- |

| |{{Flag|Brunei}} | | |文莱 |

| |[[文件:Yes_check.svg|15x15像素]] Legal to trade and hold | | |[[文件:Yes_check.svg|15x15像素]] 持有及交易合法 |

| ----Bitcoin and cryptocurrency is not legal tender in Brunei Darussalam and are not regulated by AMBD (Brunei Monetary Authority). It is not protected under the laws administered by AMBD.<ref>{{Cite web|url=https://www.ambd.gov.bn/SiteAssets/Lists/News/News/AMBD%20Press%20Release%20-%20Cryptocurrencies.pdf|title=Press Release|website=Ambd.gov.bn|access-date=12 December 2018|archive-date=15 December 2018|archive-url=https://web.archive.org/web/20181215223312/https://www.ambd.gov.bn/SiteAssets/Lists/News/News/AMBD%20Press%20Release%20-%20Cryptocurrencies.pdf|url-status=dead}}</ref> | | ----比特币和加密货币在文莱达鲁萨兰国不是法定货币,不受 AMBD(文莱金融管理局)监管。它不受AMBD管理的法律保护。 |

| | | 然而,AMBD建议公众不要轻易被任何投资或金融活动广告所诱惑,并在参与前进行尽职调查并正确了解金融产品。没有法律规定持有或交易比特币是非法的。 |

| AMBD however, advised the public not to be easily enticed by any investment or financial activity advertisements, and to conduct due diligence and understand the financial products properly before participating. There is no law that stated that holding or trading bitcoin is 不合法.{{citation needed|date=November 2019}}

| |

| |} | | |} |

|

| |

|

| === Europe === | | === 欧洲 === |

|

| |

|

| ==== Central Europe ==== | | ==== 中欧 ==== |

| {| class="wikitable sortable" style="text-align:left" | | {| class="wikitable sortable" style="text-align:left" |

| ! style="width:120px;" |'''国家或地区''' | | ! style="width:120px;" |'''国家或地区''' |

| !'''合法性''' | | !'''合法性''' |

| |- | | |- |

| |{{flag|Austria}}{{anchor|Austria}} | | |奥地利 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Not considered to be an official form of currency, earnings are subject to tax law. | | ----收入不被视为官方货币形式,受税法约束。 |

| | | 金融市场管理局(FMA)警告投资者,加密货币是有风险的,FMA不监督或监管虚拟货币,包括比特币或加密货币交易平台。 |

| The Financial Market Authority (FMA) has warned investors that cryptocurrencies are risky and that the FMA does not supervise or regulate virtual currencies, including bitcoin, or cryptocurrency trading platforms.<ref name="RCAWJune2018LOC" />{{rp|30–31}}

| |

| |- | | |- |

| |{{flag|Croatia}}{{anchor|Croatia}} | | |克罗地亚 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Croatia's Financial Stability Council warned investors about the risks of virtual currencies, such as digital wallet theft and fraud, on 18 December 2017. The National Bank of Croatia issued a similar warning on 22 September 2017.<ref name="RCAWJune2018LOC" />{{rp|33}} | | ----克罗地亚金融稳定委员会于2017年12月18日警告投资者注意虚拟货币的风险,例如数字钱包盗窃和欺诈。克罗地亚国家银行于2017年9月22日发出了类似的警告。 |

| |- | | |- |

| |{{flag|Czech Republic}}{{anchor|Czech Republic}} | | |捷克共和国 |

| |[[文件:Yes_check.svg|15x15像素]] Legal | | |[[文件:Yes_check.svg|15x15像素]] 合法 |

| ----Businesses and individuals who buy, sell, store, manage, or mediate the purchase or sale of virtual currencies or provide similar services must comply with the anti-money laundering law.<ref name="RCAWJune2018LOC" />{{rp|33–34}} | | ----购买、出售、存储、管理或调解购买或出售虚拟货币或提供类似服务的企业和个人必须遵守反洗钱法。 |

| | | 出于会计和税收目的,比特币被归类为无形资产(而不是电子货币)。 |

| Bitcoin is classified as an intangible asset (not as electronic money) for the purpose of accounting and taxes.<ref>{{cite web|title=Bitcoiny a právo: do jaké škatulky kryptoměnu zařadit?|url=https://www.mesec.cz/clanky/bitcoiny-a-pravo-do-jake-skatulky-kryptomenu-zaradit/|access-date=14 December 2017|archive-date=14 December 2017|archive-url=https://web.archive.org/web/20171214125004/https://www.mesec.cz/clanky/bitcoiny-a-pravo-do-jake-skatulky-kryptomenu-zaradit/|url-status=live}}</ref><ref>{{cite web|title=Sdělení Ministerstva financí k účtování a vykazování digitálních měn|url=https://www.mfcr.cz/cs/verejny-sektor/ucetnictvi-a-ucetnictvi-statu/ucetnictvi/legislativa-v-ucetnictvi/2018/sdeleni-ministerstva-financi-k-uctovani-31864|website=Mfcr.cz|date=15 May 2018|publisher=Ministerstvo financí České republiky|access-date=22 May 2018|archive-date=23 May 2018|archive-url=https://web.archive.org/web/20180523011107/https://www.mfcr.cz/cs/verejny-sektor/ucetnictvi-a-ucetnictvi-statu/ucetnictvi/legislativa-v-ucetnictvi/2018/sdeleni-ministerstva-financi-k-uctovani-31864|url-status=live}}</ref>

| |

| |- | | |- |